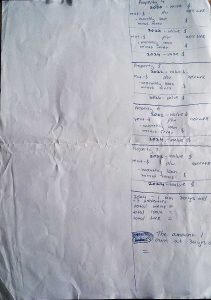

In my journey, I briefly mentioned that I got into personal finance and investment books at an early age and had sketched out a rough plan to “save, invest in shares, develop property and retire by 30”. Well I dug up the plan and took a photo of it:

| The original document, written in 2008 when I was 15: | |

|

|

It’s missing some key information because the idea was running through my head that I didn’t need to work 9-5 for 40 years — that I could probably manage to be a millionaire by 30. The plan is very rough and only has numbers and calculations I could do easily enough in my head.

From reading the document, you could probably tell the following things about me:

- I was very forward thinking: I had only lived 15 years of my life and I was already planning the next 15

- I was very familiar with money and numbers, particularly property investing

- My mind must have been on something else because I never finished the calculations

- I had messy handwriting

The plan used is very basic and was only to be used as a proof-of-concept for the idea running through my head. It only assumes property appreciation (no renovation or development), even though I was considering shares, property renovation, and property development at the time. The plan analysed the following strategy:

- Work as much as sustainable during VCE/high school and university, while still allowing for high marks

- Save as much as I could without restricting my lifestyle too much (assumed two thirds of all income was saved)

- Buy my first investment property before 22 years of age, funding the difference between the rent and interest payments with my full-time work in an accounting role

- When the equity in the first property plus my savings got to the right level, use them to buy the next property

- Rinse and repeat as often as possible

- At 30 years of age, have the option to keep things as they are or just sell the majority of the properties to pay down the debt on the remaining, and live off the (growing) rental income

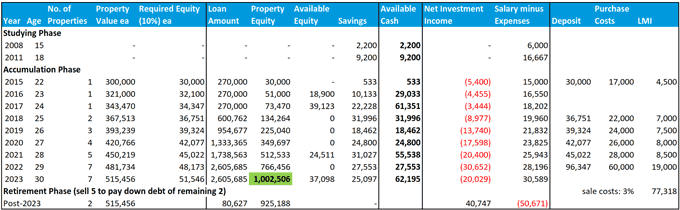

If you are interested in the detail and feasibility of this plan, check out the below spreadsheet I put together that completes my 15yo self’s plan with more accurate and complete numbers.

My recreation and update of the old plan:

Click here to get the spreadsheet

Click here to get the spreadsheet

Retiring by 30

Now would be a good time to point out the flaws in the plan:

- It relies on a number of assumptions that do not always hold true

- Property values will increase by 7% p.a. on average every year (not true in today’s property market)

- You have parents that can be guarantors for your initial loan. Otherwise, the bank may ask you to hold your full-time job for at least 12 months before they will lend you money

- Your salary is high enough for the bank to believe it can service the loan

- Your salary begins at $55k out of university and increases by 5% every year (not unreasonable — you might even expect higher pay rises early in your career)

- Your lifestyle expenses increase with inflation at 3% p.a. (in reality you might choose to upgrade your car or lifestyle, have a wedding, or start a family before 30)

- I haven’t included land tax expenses which would be incurred each year, neither have I included capital gains tax on the sale of the five properties

- The cash flow timing is a bit out. For example, if equity plus savings was going to be large enough by the end of the year that you could have purchased another property, I assumed it was purchased at the beginning of the year, so net investment income from that property is included for the entire year and not just from the date of purchase to the end of the calendar year

- It’s oversimplified. I would never just buy a property and hold onto it. I’d buy a property that I could renovate cosmetically, knock down some interior walls, and/or develop at some point. Also, nothing is happening with the cash savings when I would actually have it in a mortgage offset account so I would pay less interest on the loans, or at least be investing it in shares

Besides the above points, however, the strategy is sound and is one that is encouraged by some wealth management companies. I can think of two main reasons why it works:

- Forced savings: with a huge and growing amount of debt and the interest payments that accompany it, you are forced to save a significant portion of your income. In the example in the spreadsheet, I assume lifestyle expenses stay at $40,000 plus inflation — this resembles an individual who doesn’t want to upgrade their lifestyle while they have huge amounts of debt to pay off

- Leverage: Think of leverage as a multiplier of returns (positive or negative) and therefore risk

e.g. you could put $10,000 into shares or you could borrow 90% of a $100,000 property. A 10% return on each investment leads to the shares going to $11,000 (a profit of $1,000 and a CCR1 of 10%), and the property goes to $110,000 (a profit of $10,000 and a CCR of 100%)- Banks are generally pretty happy to lend you up to 80% of a property’s value, but perhaps only about 30% of the value of your shares. Additionally, if you’re willing to pay lender’s mortgage insurance like I did in the spreadsheet, the bank could lend you up to about 90%

Why I Changed Plans

I am no longer following this plan. As mentioned in my post on renting vs buying a house:

- The opportunity cost of tying up my money was too big

If you can create a successful business, you can get to millionaire status/retirement faster than with property. Compare the pros and cons of different money making methods to get an insight into what might work best for you - I don’t want the restriction

Getting a loan requires that you have a stable and consistent income to fund it. In other words, it would mean I would have to: (a) have gone straight into a typical graduate position in accounting; or (b) wait a year or two until my businesses bring in enough consistent income that the bank would give me a loan. Since I believe I’m much better off running my own business, I wasn’t going to get a loan any time soon - The property market seemed to have hit a peak

Given the above points, I didn’t bother spending a week or two researching the property market and developing a more accurate opinion of what property prices were going to do. Regardless, it seems my assumption was valid. Buying just any property this year seems to be a bad move. You’d have to dig around for the perfect house in the perfect area to get a decent return

Cash-On-Cash Return — cash profits/losses divided by your initial cash investment ↩